The Convergence of Food and Beauty: 8 trends in the naturals market

Truly dawning on the world of an all time high demand natural and sustainable products, the Sustainable Cosmetics Summit could not have been better timed, organized by Organic Monitor. Having shared my views on how to market products with green ingredients at their former conference, this one was upgraded with consumer insights into the demand for natural products, and a surprising convergence with the food industry.

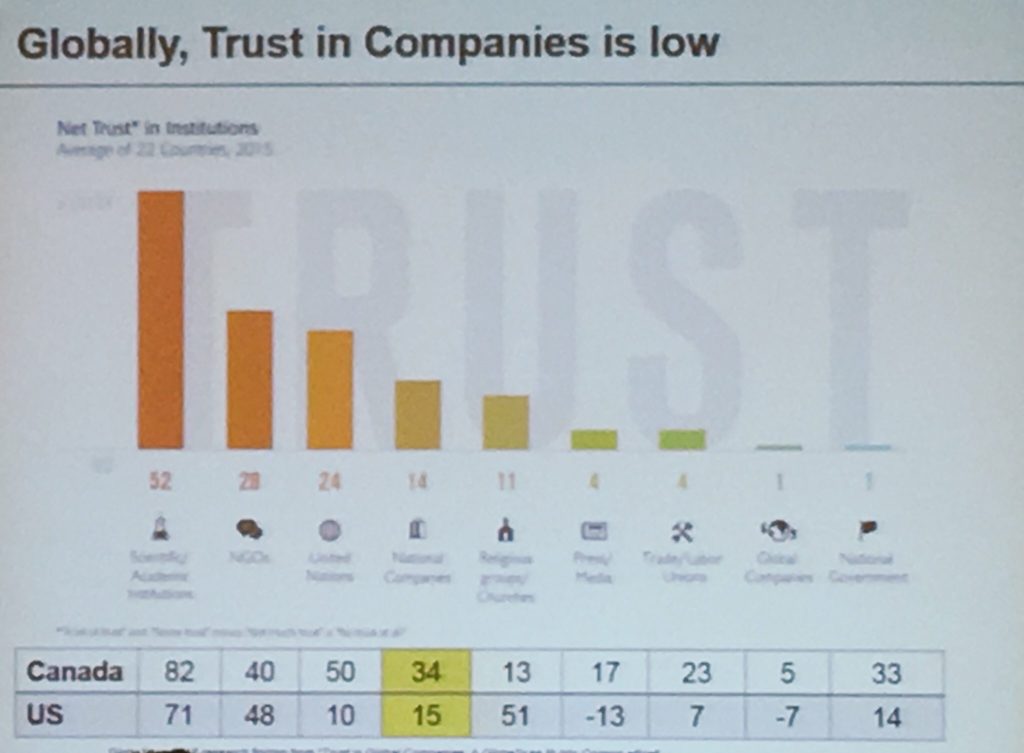

Global market drivers are faced with in-market challenges

There are numerous drivers that are aiding the boom in natural product demand. An aging population of boomers who wants to look and feel good promises a steady demand. Further, the need for for less invasive beauty products and more natural ingredients is perhaps owing to an exponential growth in natural product demand, often fueled by social media and educational marketing. The problem that manufacturers and beauty brands often face are a plethora of regulatory challenges, a lack of complied efficacy compared to non-natural products, all of which has escalated consumer skepticism. The disparity between branding, quality, price and evidence of product performance continues to boggle consumers who, while in need of natural products, are at a flux of how to spend their dollars. There is thus an opportunity to clearly and articulately educate consumers on the usage, production, and most importantly, the benefits of natural ingredients in products.

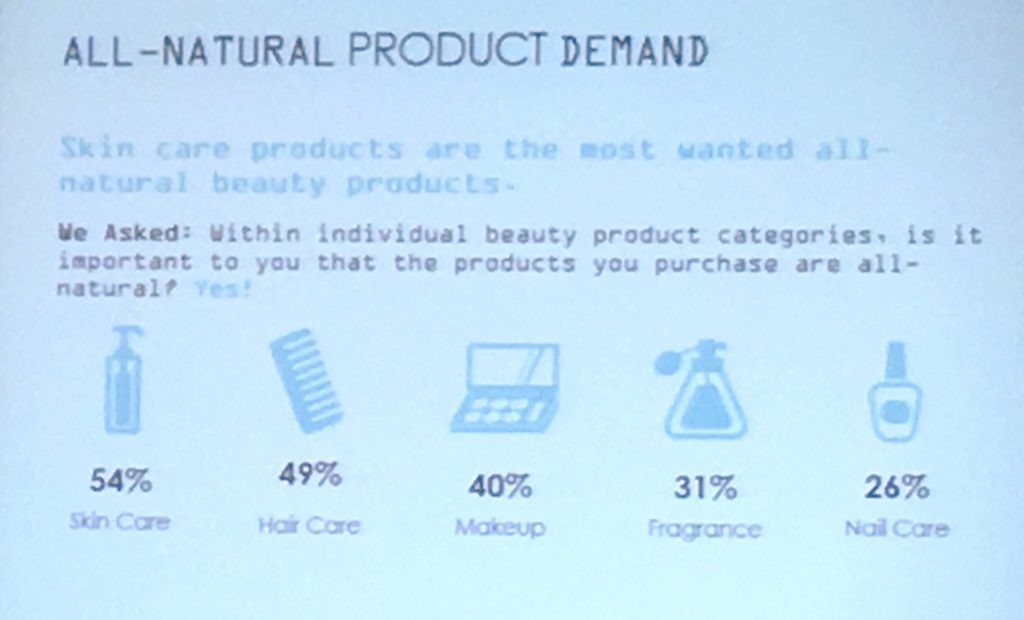

‘All Natural’ demand varies by cosmetic category

While natural is a buzz word, the lack of education and clarity around it, and differentiators with organic, green and sustainable, have ultimately caused a global low in trust, factually shown by Jennifer Lambert Loblaws Ontario. However, despite not trusting product claims and company promises, the demand for natural is still strong. While all natural cosmetics are very much in demand, 54% of women demand their skin care be all natural, the highest of any beauty category. This is followed closely by hair care at 49% and makeup at 40%. Of the 60% of women who read beauty product ingredients prior to purchase, most even predict increased prices and spending for skin care natural products over the upcoming 2 years. This, and many other statistics were unraveled by founders of eco-friendly skincare brand Kari Gran.

Skin care in the ‘All Natural’ demand spotlight

The impact showcases the need for beautiful skin, above all other cosmetic treatments, and places pressure on skincare brands to seek efficacious and natural ways to convey the same benefits. Skin care brands typically claim to protect, strengthen or hydrate skin. Sub-claims include anti-aging ones (for balance, detoxification, protection from radicals), or exhibit desired skin textures (firmness, anti-cellulite, etc.). Several solutions to ingredients that could offer these were brought to light, including Vitamin C, natural flavonoids in cocoa, green tea, grapeseed, pumpkin seed oil, and a number of unsaturated fatty acids in Omega 3, 7 and 9. While promising lasting results, such ingredients come with a caveat of increasing raw material prices and consequently product prices, a fact that needs to be weighed into the business dynamic of the cosmetic industry.

Consumers are willing to pay more for ‘All Natural’ cosmetics

It is no surprise that to promise the same level of product efficacy, manufacturers are faced with increased costs of natural ingredients. Thankfully, a whopping 40% of women intend to increase their spend for all natural beauty products within 2 years. Purchase growth divided within the United States has shown an increase of 47% in the west and 39% in the East, which are the larger consumers of all natural products. With an emphasis on the sustainability of a business, it was refreshing to see that consumers were indeed willing to modify their purchase trends in an evolving market.

Natural both inside and out is a growing phenomenon

There is an increasing grey area between wellness and beauty, and consumers are embracing the fact that to look beautiful, you need to be beautiful inside out. Doing good, looking good and feeling good are thus becoming synonymous, quite similar to eastern and traditional health beliefs that beautiful skin starts from within. The impact on beauty manufacturers is both a benefit and a risk: the benefit of providing products as part of a daily regimen in a healthy lifestyle, with the risk of being nullified from a daily routine and replaced by the likes of foods, superfoods, exercise and fitness.

The growth of nutri-cosmetics as a marketing opportunity

The opportunity is vast, exemplified with the potential of the nutri-cosmetics industry. With ‘is it good enough to eat’ campaigns for beauty products exhibited by Tina Nesgooda of Intelligent Nutrients, the spotlight was evidently on ingredients being so natural that one could gobble them up! Similarly, Bob Purcell, CMO of 100% Pure showcased how the brand successfully made beauty products using food ingredients. These brands have shown that to appeal to consumers, one must strike the right chord with them and make the beauty benefits obvious, appealing, and very clear.

Oral supplements are a growing choice, being marketed as inside beauty

78% of Americans agree that dietary supplements are a smart choice for leading a healthy lifestyle, as per Nutri Cosmetics formulator Paula Simpson. And ironically enough, most of these people already lead healthy lifestyles: they eat balanced diets, visit the doctors regularly, and exercise often too. The market for oral health and beauty products is thus larger than ever before, and combined with the food and beauty blur, opens up opportunities for collaborations between food and cosmetic manufacturers to offer regimen based solutions to natural beauty.

Millennials, the sharing economy and the convergence of food and beauty

Every new marketing trend must have an audience. There has been an increased focus on millennials, which while a smaller proportion of the population compared to boomers, and one with less disposable income, is one that is becoming the face of trying new products and embracing revolutionary changes in the industry. As SDS Parsons’ professor Raz Godelnik stated, “The millennial sharing economy is an opportunity, not a threat, to sustainability marketing.” Using UBER and other mainstream tech examples as a benchmark, it was evident why they are leading the convergence of foods and beauty. For example, millennials are keen on super foods, and are often large users of food and herbal supplements, blurring the lines between beauty and nutrition. Combined with their highest levels of fitness in human history, they are a key market for all natural beauty products. In fact, over 50% of them purchase ingredients with fewer ingredients, and even gravitate towards food based, pronounceable and familiar ingredients in their products.